- The Gore Report

- Posts

- I’ve been a Marvell shareholder the last 5 years and now it’s time for the chipmaker to reach its full potential.

I’ve been a Marvell shareholder the last 5 years and now it’s time for the chipmaker to reach its full potential.

Marvell is now at an inflection point and has the wind at its back, for now.

Five years‼️ That’s how long I’ve been riding the Marvell wave as a shareholder—through the choppy waters and those occasional moments when you wonder if you’re on the right boat after initially holding Nvidia around the same time frame. Let me be honest: some of those down moments weren’t just about market volatility or chip cycles. They were about listening to CEO Matt Murphy sit on earnings calls and somehow manage to undersell what should have been clear victories.

I’ve sat through multiple quarters where the fundamentals looked strong, the execution was there, but Murphy’s conservative language or overuse of the word “lumpiness” set a negative tone that would send the stock tumbling in after-hours trading. Not good. You’re sitting there as a shareholder thinking, “Just tell the Street what you’re actually accomplishing!” The same way Jensen Huang does with Nvidia. But yesterday felt different. Maybe Murphy finally found his rhythm, or maybe the story has become so undeniable that even cautious commentary can’t obscure it. Either way, the stock held up, and I’ll take that as progress.

The Santa Clara chipmaker delivered Q3 fiscal 2026 revenue of $2.075 billion, crushing expectations and marking a 37% year-over-year surge. Non-GAAP earnings came in at 76 cents per share, beating the Street’s forecast of 73 cents. Those are impressive numbers. But here’s the thing about Marvell—the story has never been just about hitting quarterly targets. It’s about positioning itself at the absolute center of the AI infrastructure revolution, and yesterday’s announcements made it clear they’re doing exactly that.

Yahoo Finance

The Data Center Explosion

Let me put this in perspective: Marvell’s Q3 revenue grew 19% sequentially, well above guidance, driven by strong AI demand. The company is now guiding for another 19% sequential jump in Q4, which would push full-year growth past 40%. When you’ve been holding a stock through the lean years—and through earnings calls that inexplicably tanked the stock despite good results—those kinds of numbers feel like validation.

Marvell Investor Relations

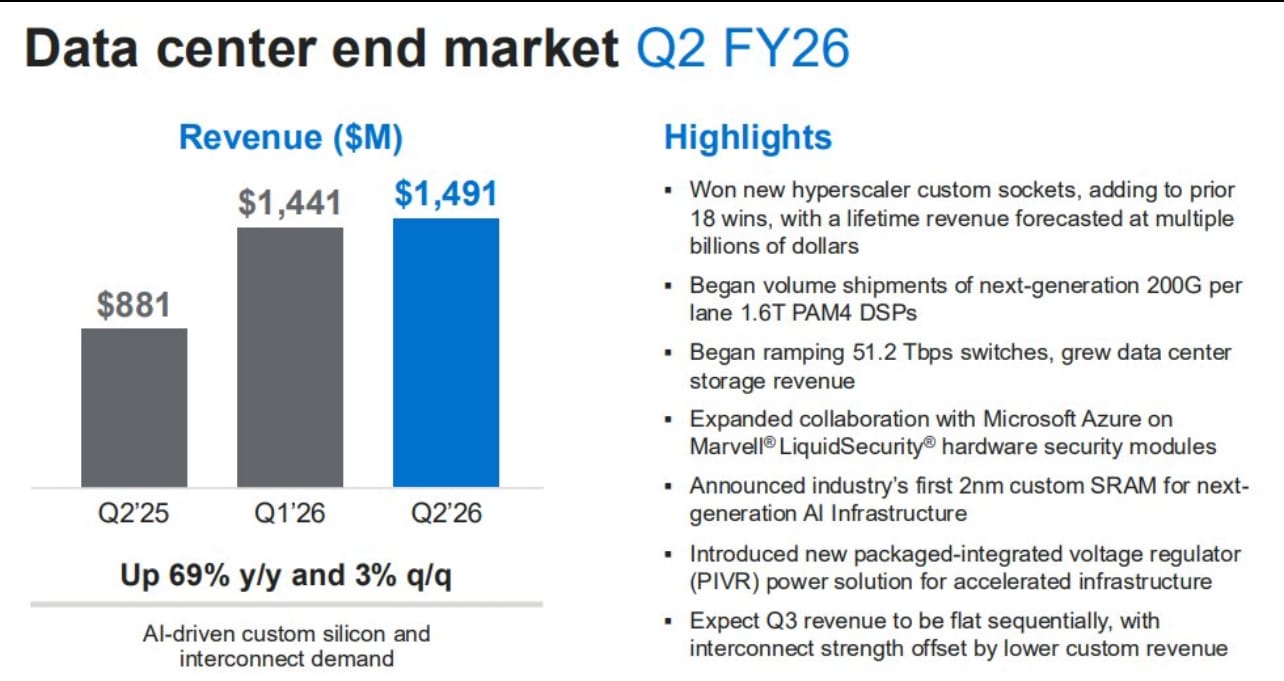

What really caught my attention was how data center revenue has become the dominant force in Marvell’s business. We’re talking about a segment that’s transformed from a supporting player to the star of the show. The company’s custom AI chip business—those specialized chips they design for the hyperscalers—have entered reach production. Translation: this isn’t a speculative play anymore. They’re shipping real products at scale.

And here’s what matters: Murphy and the team articulated this clearly yesterday. No hedging, no excessive caution that makes analysts second-guess the guidance. Just straightforward communication about where the business is headed. After years of frustration with Marvell’s messaging, I’ll celebrate the this victory.

The Celestial Acquisition: A Bet on Tomorrow’s Architecture

Now, about that $3.25 billion announcement that dropped alongside earnings. Marvell is acquiring Celestial AI, a startup focused on photonic interconnects. If that sounds technical and esoteric, let me break down why this matters—and why it could be absolutely transformative.

AI infrastructure is evolving beyond single-rack configurations into multi-rack systems connecting hundreds of chips with high-bandwidth, ultra-low optical fabric. The problem with copper interconnects is that they’re hitting physical limits. You can only push so much data through copper wires before you run into issues with power consumption, heat, and distance. Optical connections—using light instead of electricity—solve these problems elegantly. This is the direction Marvell is going.

The deal structure tells you everything about Marvell’s confidence. They’re paying $3.25 billion upfront ($1 billion cash, the rest in stock), with an additional $2.25 billion in earnouts if Celestial hits $2 billion in cumulative revenue by fiscal 2029. That’s aggressive. That’s betting big and frankly, after five years of watching this management team execute—even if their communication hasn’t always matched their performance—I’m inclined to trust their judgment on technology bets. See Marvell’s Inphi acquisition in 2020.

Marvell expects Celestial to start contributing meaningfully to revenue in the second half of fiscal 2028, hitting a $500 million annualized run rate by Q4 2028 and doubling to $1 billion by Q4 fiscal 2029. Those are long-dated projections, yes. But they signal where the AI hardware market is headed: toward massive clusters that need optical interconnects to function.

The Amazon Factor: Why This Partnership Changes Everything

Here’s where things get really interesting for us Marvell shareholders. Amazon Web Services didn’t just make a cameo in yesterday’s earnings—they’re becoming central to Marvell’s bull case. And given Amazon’s announcement this week about their Trainium 3 chip, the timing couldn’t be more perfect.

Marvell announced an expanded five-year multi-generational agreement with AWS, covering custom AI products including the AWS Trainium 2.0 custom AI chip, optical processors, data center interconnect modules, and Ethernet switching silicon. This isn’t a one-and-done chip design. This is a comprehensive partnership spanning multiple generations of technology. This is important because there was market concern that AWS could potentially ditch Marvell as an ASICS partner. Now we have confirmation this is not the case.

Amazon’s Trainium chips represent their bold attempt to break Nvidia’s stranglehold on AI training hardware. Here’s what’s key: AWS claims Trainium can cut AI model training and usage costs by up to 50% compared to GPU-based systems offered by Nvidia and AMD. At AWS re:Invent this week, they unveiled Trainium 2 Ultra servers and announced Trainium 3 for late 2025, promising a fourfold performance improvement over Trainium 2.

Why does this matter for Marvell? Because they’re not just a supplier—they’re a co-design partner. Marvell’s lead custom chip program for a large US hyperscale customer, widely understood to be AWS, is doing extremely well and has become a key revenue driver, with production using first-generation silicon. The company is already working on Trainium 3 and helping define specifications for Trainium 4.

Think about the implications here. Amazon is one of the largest technology companies on the planet, spending tens of billions annually on infrastructure. They’re making a massive push into custom silicon to reduce dependence on Nvidia. And Marvell is their primary partner for making that happen. This kind of strategic positioning is everything.

The Nvidia Alternative Narrative

Let’s address the elephant in the room: Nvidia still dominates AI hardware with a market share around 95%. Their GPUs remain the gold standard for training large language models. But the market is starting to shift in subtle yet meaningful ways.

AWS’s strategy is twofold: provide cheaper AI alternatives with Trainium offering 30-40% lower costs than Nvidia GPUs, and scale infrastructure with plans to deploy Trainium 2 chips across data centers. Major tech companies including Apple, Adobe, and Anthropic have been testing Trainium chips and reporting promising results.

Marvell sits at the intersection of this shift. They’re enabling the hyperscalers to build viable alternatives to Nvidia, not by competing head-to-head in general-purpose GPUs, but by creating highly optimized, application-specific chips. It’s a smarter play. Instead of trying to out-Nvidia Nvidia, they’re helping customers build exactly what they need for their specific workloads.

What This Means Looking Forward

Marvell expects roughly $10 billion in total revenue for fiscal 2027, including a 25% jump in data center revenue. For context, the company did $5.767 billion in fiscal 2025 revenue. So we’re talking about doubling the business in just two years.

The deeper AWS partnership provides visibility into multi-year revenue streams from one of the world’s largest cloud providers. And the broader trend toward custom silicon plays directly into Marvell’s core competency. This is what I’ve continued to hold Marvell stock. At some point, the appetite for Hyperscalers to rely solely on Nvidia for chips will begin to decrease.

Now, I’m not naive. There are legitimate questions about competition, about execution risk on these massive custom chip projects, about whether the earnouts from Celestial will actually materialize. And I’m still keeping one eye on how Murphy communicates in future quarters—yesterday was encouraging, but one good earnings call doesn’t erase years of frustration with how the company has articulated its wins to Wall Street.

But here’s what I’ve learned over five years of holding Marvell through the ups and downs, through the disappointing calls and the inexplicable stock drops (60% drop from January 2025 to April 2025): this management team has consistently delivered on execution, even when they haven’t always delivered on communication. They’ve transformed the company from a diversified chip vendor into a focused data center powerhouse. The custom silicon business that barely existed a few years ago now drives the majority of revenue growth.

The Bottom Line

Bottom line on $MRVL:

✅Earnings crushed expectations

✅ Data center business exploding

✅ $3.25B bet on AI's future

✅ $10B revenue target for 2026

✅ Stock breaking to new highs

✅ Wall Street analysts are raising Price Targets

The numbers from yesterday were solid—great, even. Revenue beat, earnings beat, guidance raise. Check, check, check. But the real story is strategic positioning. Marvell just made a multibillion-dollar bet that optical interconnects will be fundamental to future AI architectures. They deepened their partnership with Amazon at the exact moment AWS is challenging Nvidia’s dominance. They’re shipping production volume on next-generation custom AI chips.

And perhaps just as importantly, they managed to communicate all of this without shooting themselves in the foot. For a shareholder who’s watched the stock drop after strong quarters because of overly cautious language or failure to emphasize the right metrics, that’s almost as meaningful as the financial results themselves.

The shift toward custom silicon is happening. And Marvell is positioned right in the middle of it all. The next few years will tell the tale. But for now, I’m staying buckled in for the ride—and hoping Murphy keeps finding the words to match the execution.