- The Gore Report

- Posts

- TheGoreReport: June CPI came in hotter than expected but Core CPI was cooler. What does this mean and where do we stand?

TheGoreReport: June CPI came in hotter than expected but Core CPI was cooler. What does this mean and where do we stand?

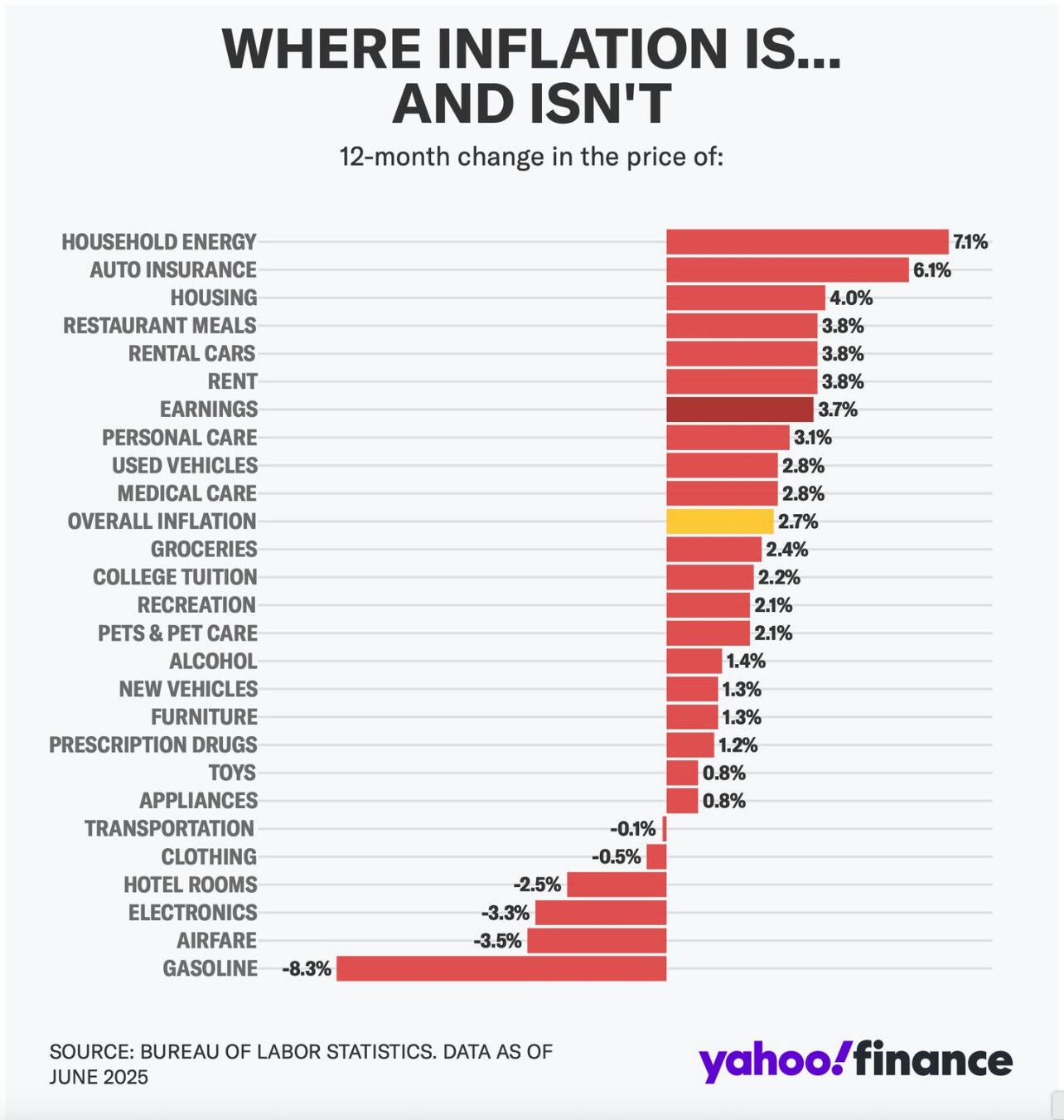

June’s CPI report came in hotter than expected, posting a 0.3% month-over-month rise, right in line with expectations. But the year-over-year number climbed to 2.7%, edging past the 2.6% economists were banking on and up from May’s 2.4%. Food prices (up 0.3%), energy (up 1.0%), and shelter costs (up 0.2%) kept things on the warm side.

On the flip side, Core CPI, which sidesteps the volatility of food and energy, stayed a calmer, rising 0.2% month-over-month against a 0.3% forecast. Year-over-year, hit 2.9%, just shy of the expected 3.0% but ticking up from May’s 2.8%. Softer car prices and airfares helped keep Core CPI in check. It’s a bit of a mixed signal—headline inflation’s got some spice, but core’s playing it cooler, chances are the Fed will remain neutral for the next Board meeting on July 30th.

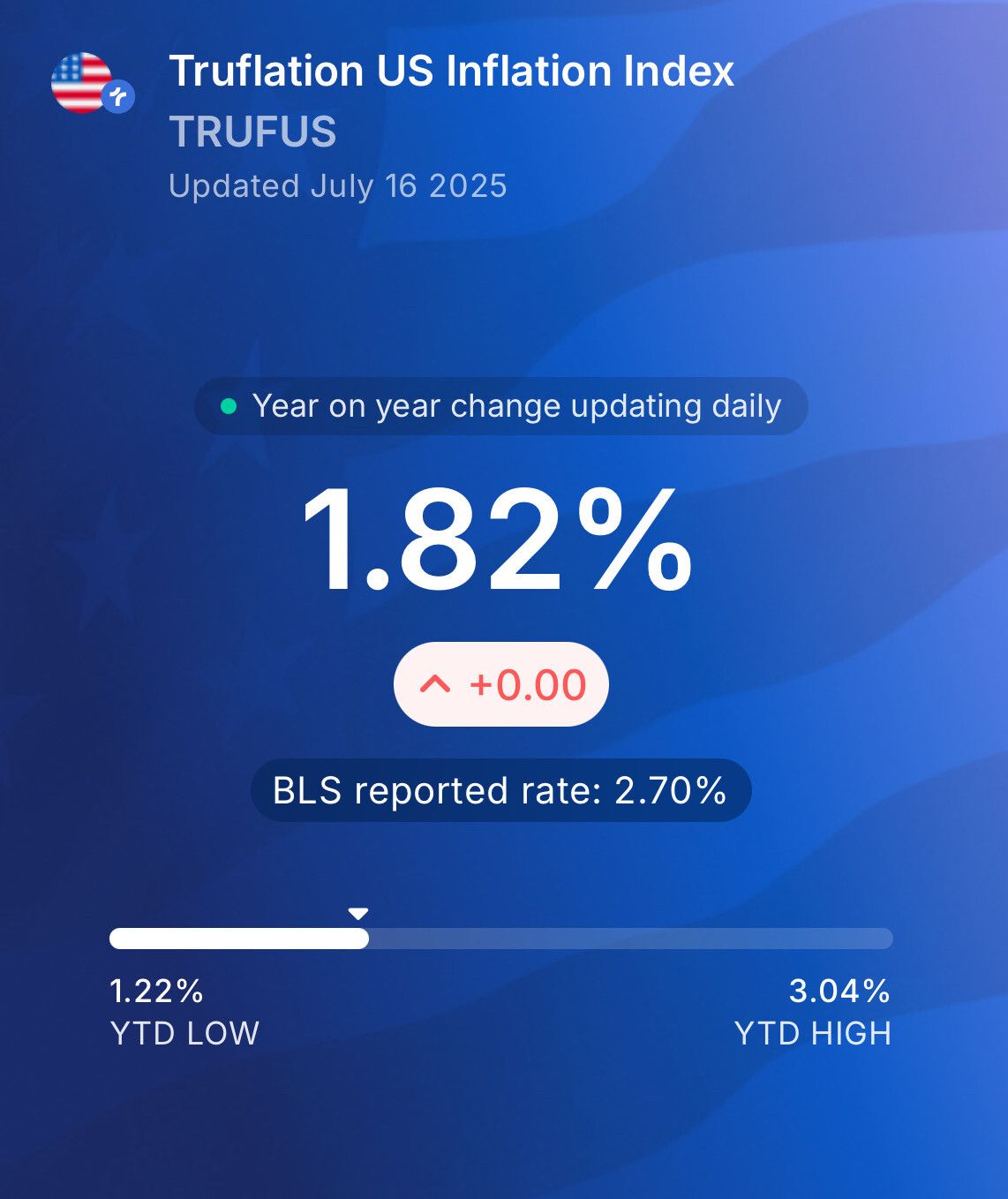

June’s hotter-than-expected CPI, likely got a temporary jolt from the Israel-Iran conflict spiking energy prices, with Brent crude jumping about 10% after tensions flared. Energy prices rose 0.9% month-over-month, pushing the headline CPI up. But this could be a one-off blip—Truflation’s daily inflation tracker,(below) 16 days into July, is already showing cooler inflation compared to June, suggesting the energy-driven spike may fade as Middle East tensions have eased due to ceasefire agreement, with Brent crude dropping back to around $69 a barrel. This signals a softer trend for a cooler July’s CPI. The Fed’s keeping a close eye but cuts for July 30th are off the table.

This was not a bad report or a good report. This report was mixed. There was good news. (decrease in Used & New cars prices) and not so good news, (increase in Car Insurance and Food). June was an abnormal month with more than a lot going on. July will be a better gauge of where this economy stands with inflation and tariffs.

For the last 3 months, Tariffs have been the main topic of conversation. Now we will get a shift to Earnings. We get a chance to see how these companies are dealing with tariffs. The key will not be if they beat earnings, but what these company’s forward guidance looks like for the next couple of quarters. The market has been reacting well through volatile news. However, for markets to take that next leg up higher from where it is right now, earnings will be what propels it.

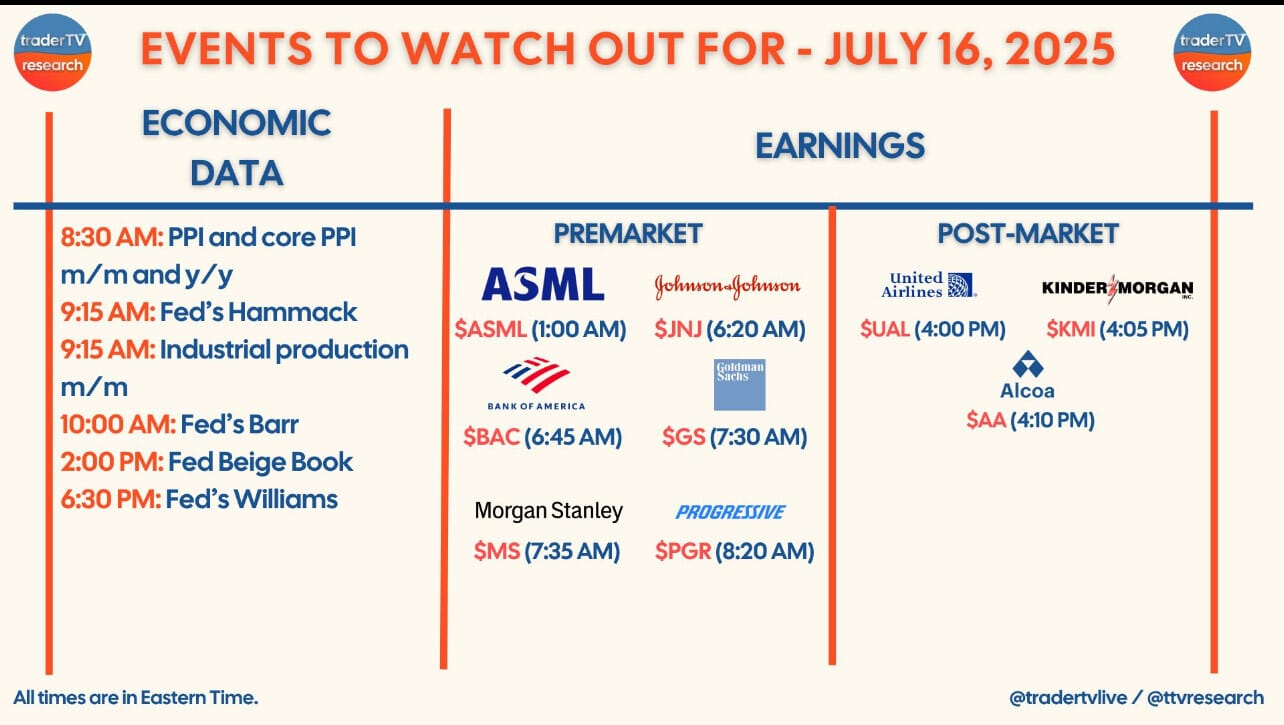

Economic Numbers & Earnings on Tap for July 16th

1) Markets got CPI on Tuesday that showed us what the consumers paid for June, now we will get an idea what the companies have been paying with PPI and just how much they have been eating tariff costs for their customers.

2) Banks will again be heavy on the earnings front. Expect very good results from BAC, MS & GS. Alcoa will be key to hear just how much aluminum tariffs are changing their business. Alcoa does a ton of international business with China. So the earnings call should be more than interesting!