- The Gore Report

- Posts

- TheGoreReport: PPI came in unchanged defying yesterday's CPI, BFF's Trump & Powell back at it again and Ethereum is on fire.

TheGoreReport: PPI came in unchanged defying yesterday's CPI, BFF's Trump & Powell back at it again and Ethereum is on fire.

PPI

PPI cooler than expected.

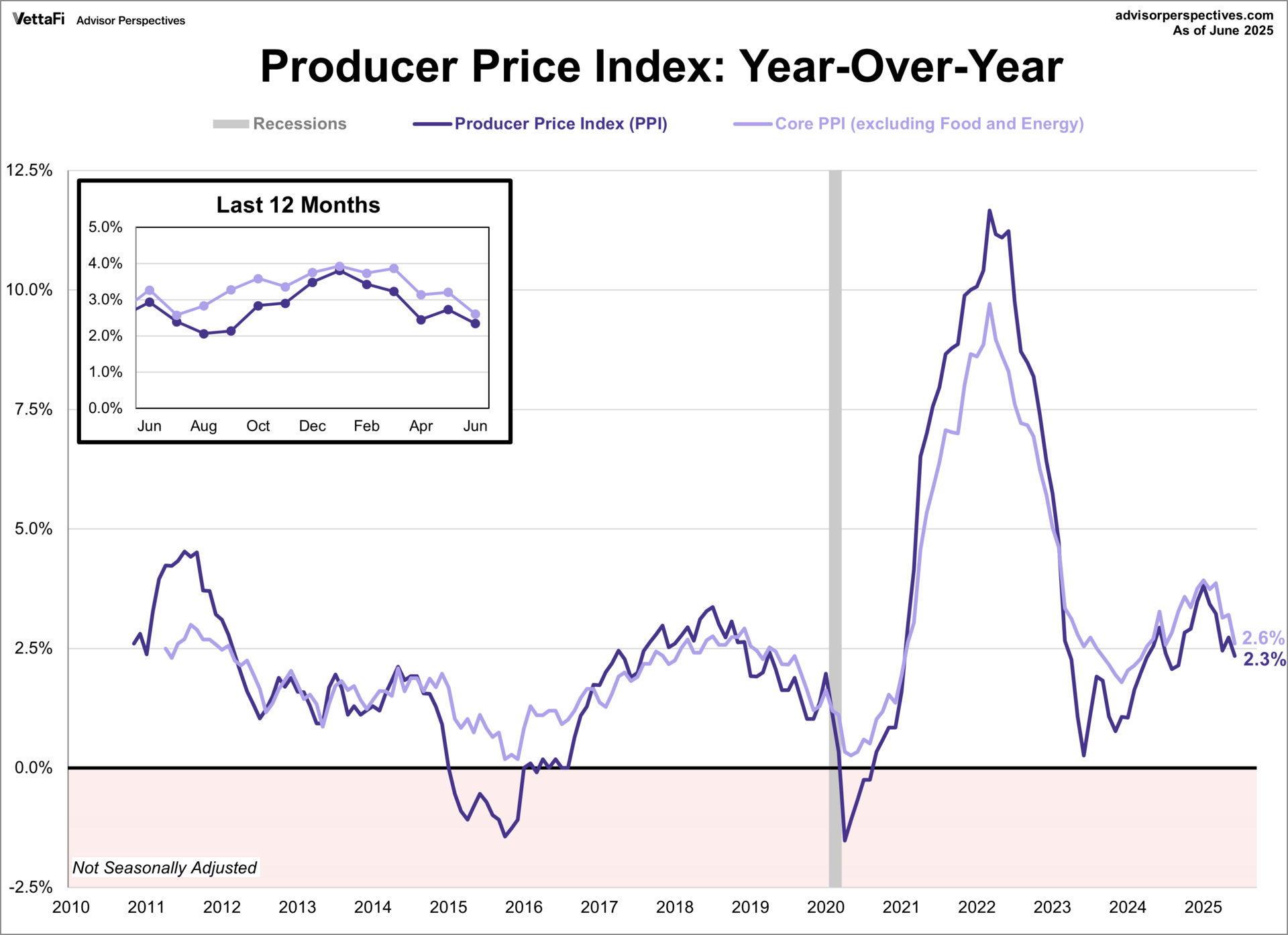

The Producer Price Index (PPI) for June 2025 showed no month-over-month change, staying flat at 0.0% from May 2025, Year-over-year (YoY), the PPI rose 2.3% while expectations were pinned at 2.5% beating expectations.

MoM Core PPI, excluding food, energy, and trade services, was unchanged in June. YoY Core PPI came in at 3.0% with an expectation of 3.1% beating expectations. The data suggests moderating producer price inflation.

What is the Real Story behind these numbers and percentages?

This is good news! After Tuesday’s slight increase in CPI Inflation for consumers, we saw no change in prices for producers. What does this mean? It means no signs of hyper-inflation or guarantee of future persistent inflation. If PPI numbers for producers are cooler than expected and relatively unchanged, then chances are the countries that are being tariffed are eating the cost of the tariffs. For the first time, consumers saw an increase in prices, mainly food and energy. As I stated in yesterday’s newsletter, this might be a short term blip because so far we are seeing less volatility for oil prices this month.

If we saw PPI come in hot, along with a mixed warm CPI number, there would be cause for some concern but June may just be an outlier for CPI. We will see.

Trump vs. Powell

Let’s get ready to RUMBLE!

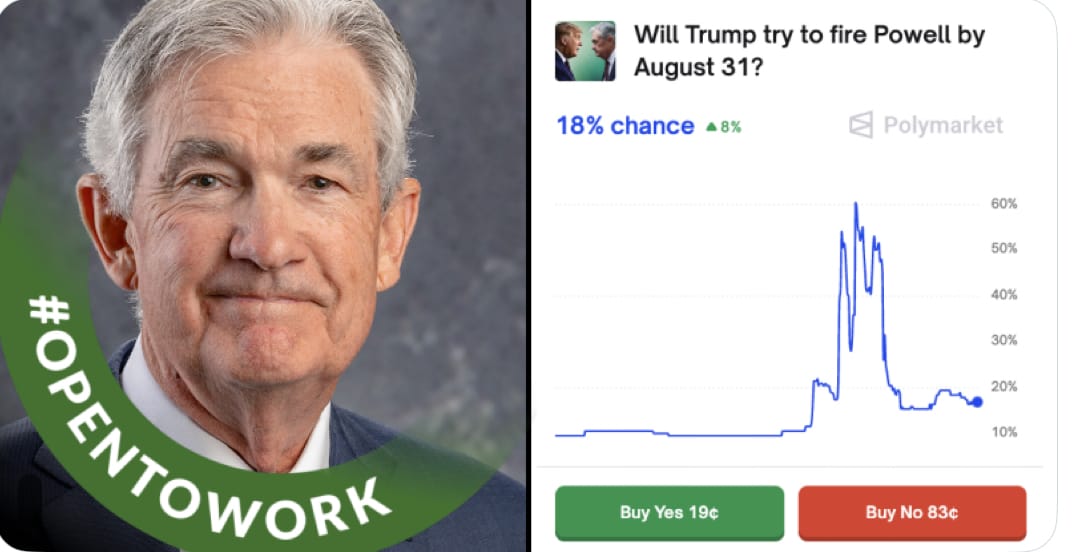

The financial world was abuzz Wednesday as President Trump sent mixed signals about the fate of Federal Reserve Chair Jerome Powell. Reports surfaced that Trump was considering firing Powell. This revert's back to Trump's frustration with Powell’s reluctance to cut interest rates which led to speculation about a dismissal was imminent. This caused not only a dip in the bond market but a market selloff as investors worried about the economic fallout of this move.

By early afternoon, Trump backtracked and said it was “highly unlikely” he would fire Powell, unless evidence of fraud emerged—a caveat that kept the door slightly ajar. Trump’s backtrack stabilized markets. Despite Trump’s push for cuts to ease economic tensions amid his tariff plans, Powell hasn’t budged.

Of course, the betting markets have an opinion.

18% probability Powell is gone by August.

What’s the Real Story behind this conflict?

President Trump wants rates lower because he has $9 Trillion in Gov’t debt that needs to be refinanced. With each passing month, the risk of hyper-inflation decreases. Powell still will not budge. From the outside looking in, Trump feels Powell’s motivation to keep rates elevated is personal. When you look at the economic numbers, Trump has a legitimate gripe. Other countries with much higher inflation have had multiple rate cuts the last few months.

My thoughts are that this story was purposely leaked by the administration. Just to put the thought of Powell’s removal in the atmosphere. A story like this, along with Powell being under investigation for mismanagement of funds for renovating the Federal Reserve building in D.C. brings added heat and pressure to the situation. There is a good chance Powell resigns or is fired due to what is discovered in this funds mismanagement investigation. Today’s news was no accidental leak.

Ethereum Takes off!

Bitcoin has been having its day now it’s Ethereum’s turn! Why?

Congress just advanced the Genius Act which will open the blockchain market for Ethereum.

Bank of America picked ETH as the infrastructure for Stablecoins. (Institutional Support)

Low supply, just like the case with Bitcoin.

Beautiful upswing chart.

Full support by the current Administration.

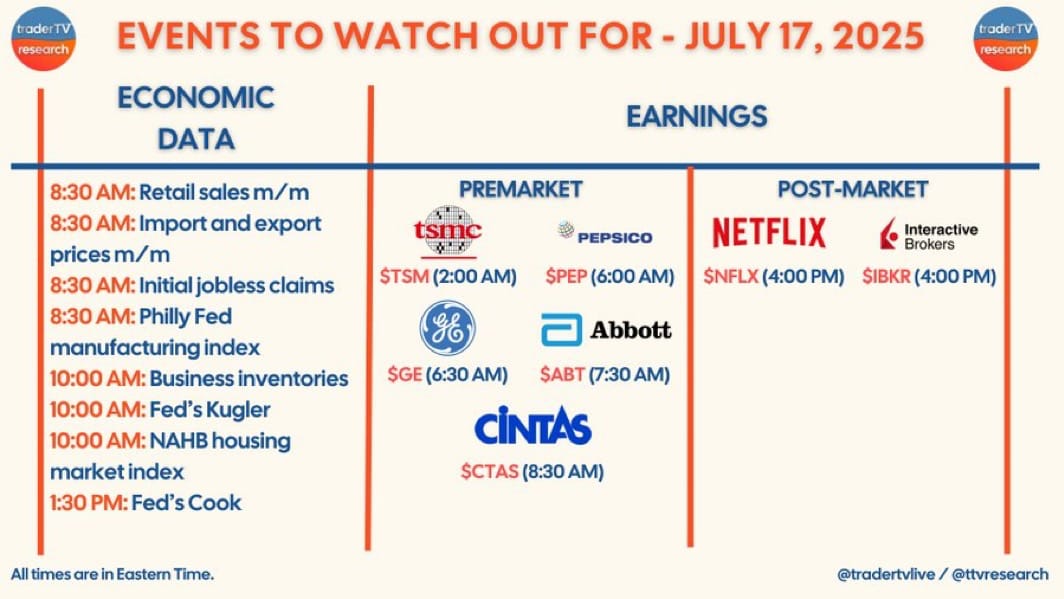

2 key reports to watch: (TSMC)Taiwan Semiconductors & (NFLX) Netflix

Enjoy!