- The Gore Report

- Posts

- TESLA Earnings. More than a car company. (July 24)

TESLA Earnings. More than a car company. (July 24)

Along with Alphabet (GOOGLE), the most anticipated earnings report this week is TESLA. It is no secret that CEO, Elon Musk has had a tumultuous first half of 2025 with his foray into politics. Having headed DOGE (Department of Government Efficiency) from January to his departure in May, it has been a whirlwind. With a volatile Tesla stock price, his electric cars vandalized and a verbal spat with President Trump, these have been trying times for the Head of Tesla. Now it is back to being a full-time CEO across his portfolio of businesses (Tesla, xAI, SpaceX, etc.) A lot to carve out here. Let’s take a look at what happened in Q2.

The Results

Tesla’s year goes from bad to worse.

Headline Numbers

EPS: Actual: $.40, Estimate: $.40 (Met)

Revenue: Actual: $22.4B, Estimate: $22.5B Est. (Miss)

Free Cash Flow (FCF): Actual: $146M, Estimate: $760M (Miss)

Revenue declined 12% YOY and here’s a few reasons why:

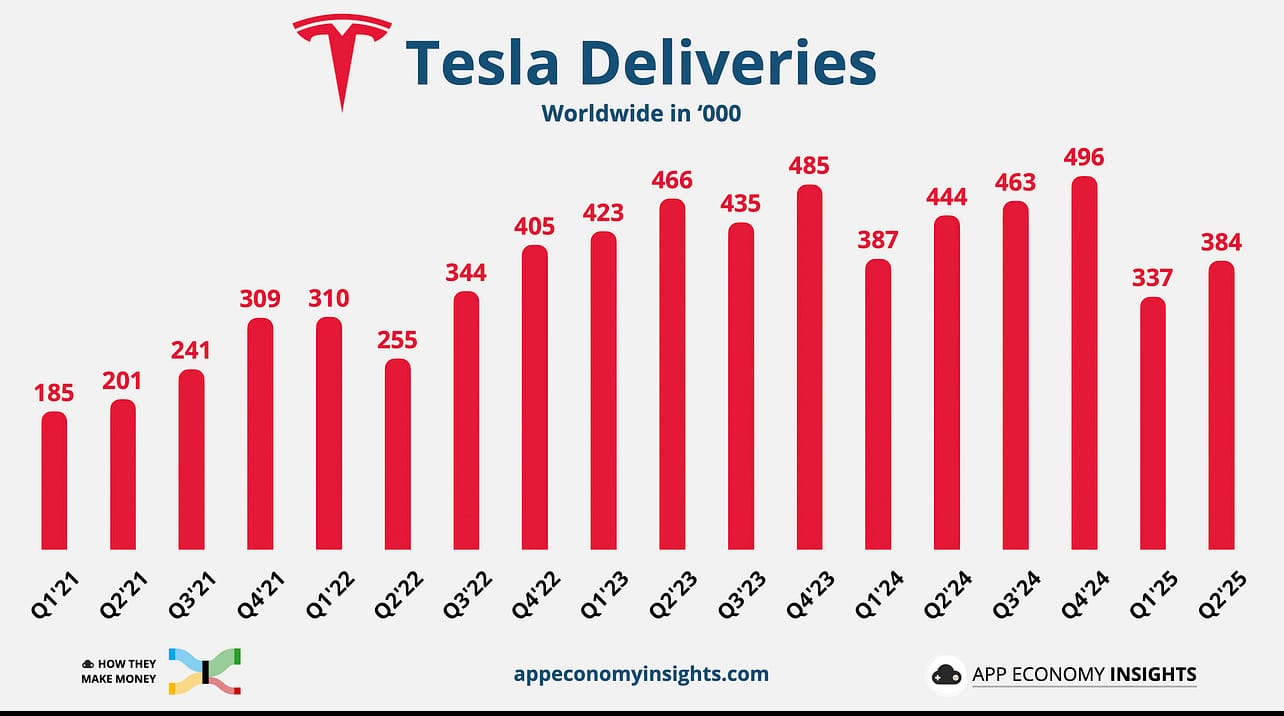

YoY Decline in Vehicle Deliveries (The Key Metric)

Courtesy of Tesla Investor Relations

Total deliveries are the #1 key metric for Tesla because it reflects the company’s ability to not only produce but sell vehicles. More deliveries will mean more income which fuels growth, expansion and of course R&D. Year over Year, Tesla deliveries saw a decline of 13%. How important was this 13% decline in total deliveries year over year? It caused a massive 89% decrease in Tesla’s Free Cash Flow (FCF).

FCF is very important for Tesla because it is a very capital-intensive company. Heavy investments in manufacturing, R&D and AI require substantial cash. What those total deliveries number really signify is the current demand for Teslas. How bad do people want this vehicle? Is the drop-off an EV thing or is it purely a Tesla brand problem?

Courtesy of Tesla Investor Relations

Between the 12% drop in Revenue, 89% decrease in FCF and the 42% cut in profit margins, the street was not impressed and that was reflected below in aftermarket trading.

Courtesy of Yahoo Finance

MY THOUGHTS

These were not good results for Tesla! Not at all. Shareholders can not be happy with declining FCF, Revenues and Margins. The question to ask here is, is this a trend? The factors below will determine.

Politics

There is without question that Elon Musk’s involvement in politics played a role in Tesla’s business struggles. You can look at the YoY decline in deliveries two ways. Either investors/consumers were not fond of Elon getting involved with politics or potential consumers were too afraid to purchase a Tesla because they did not want to get firebombed or physically attacked! If there is a silver lining of hope, the quarter over quarter delivery number (Q1 vs. Q2) did increase 14%. So maybe this is a temporary blip. However, there is talk of Elon Musk starting the ‘American Party’ so there is another avenue of concern for investors.

Lower Gas Prices

We all can agree that the EV market is no fad. It is here to stay. There is massive demand for Electric cars overall despite Tesla’s rough start to 2025. However, we have seen an over 20% drop in gas prices from the beginning of 2025. The current administration is pro-energy and the $7500 gov’t tax incentive is expiring on September 30th. When gas prices decline significantly, the demand for EV’s decline as well. I know this from personal experience. In 2022, when oil prices shot up to $120, I was all but ready to switch to electric. However, when gas prices came back down to normal, my interest evaporated. The question for the EV industry and not just Tesla is, how do you get casual car buyers to want to switch to EV’s from ICE even when gas prices are low? That will be key to growth. Gov’t tax incentives help but as of now, that is going away.

Tesla is no longer just a car company

Newsflash! Tesla is just as much an AI company as it is a car company. I recently read on Business Insider that Tesla has scaled to 67,000 H100-equivalent GPU’s. When you think of H100 GPU’s, you automatically think of semiconductor leader, NVIDIA. In the article, Musk emphasized “the importance of vertical integration in AI hardware to rival NVIDIA”. This is a smart strategy because controlling compute is vital for autonomy (not relying on other chipmakers, especially when there are supply chain issues: Think COVID19) and cost efficiencies. Musk has made it no secret that he wants Tesla to be an AI leader. So with that said, it may be a case where the mission may not be to hit EV quarterly delivery goals at the sacrifice of innovating with heavy CapEx Spending.

Courtesy Tesla Investor Relations

To me, the jury is still out on how this year will pan out for Tesla. RoboTaxi, Tesla’s autonomous vehicle designed to provide on-demand transportation without a human driver, will soon roll out and there is much fanfare. The plan is to expand to half of the U.S. by end of year. Tesla wants to scale in the next few weeks to Nevada, Florida and Arizona. So Tesla has its hands in on a lot of really neat stuff. With that said, I think it is safe to say that the less Elon Musk is focused on politics, the better his portfolio of businesses, Tesla, SpaceX, xAI will perform.

|