- The Gore Report

- Posts

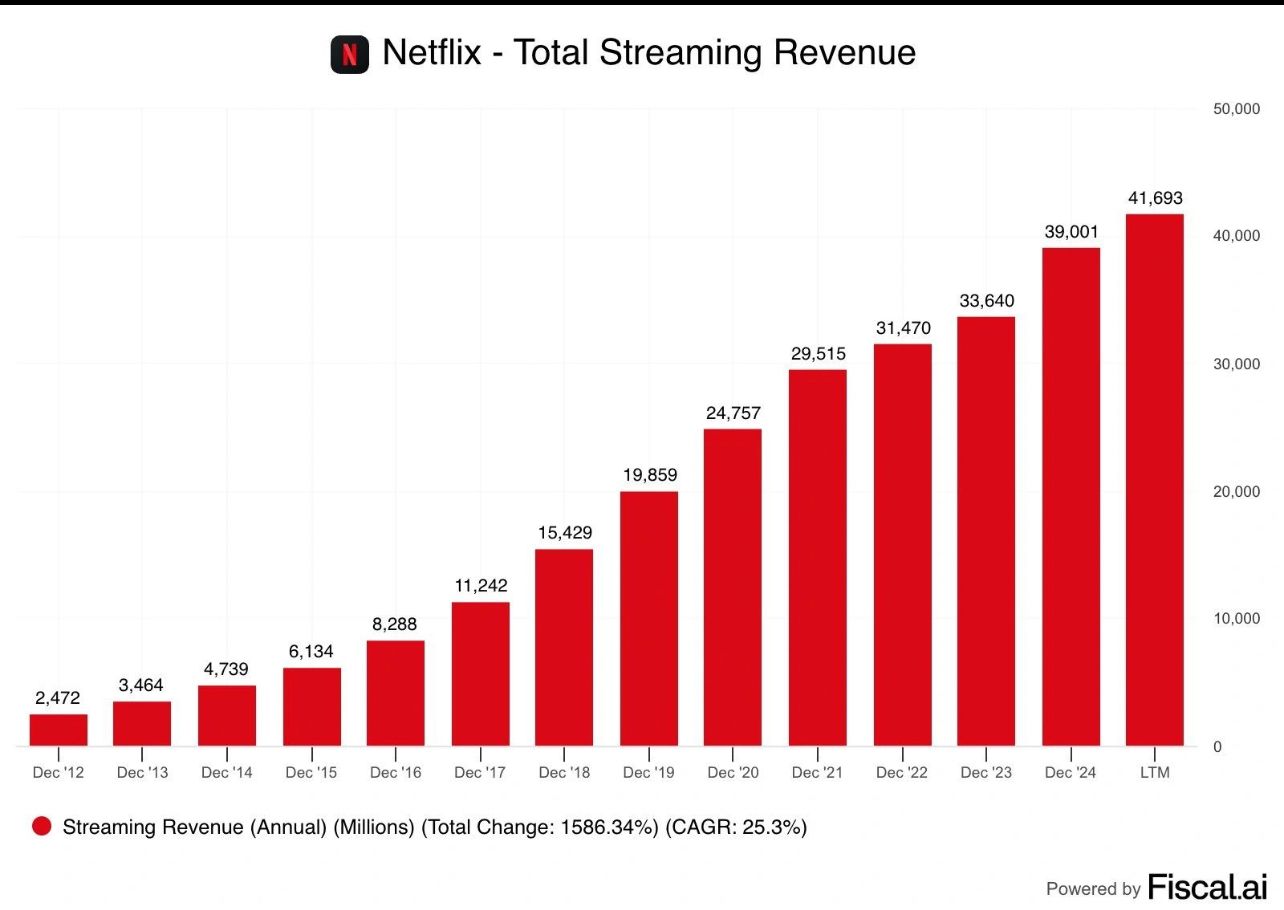

- TheGoreReport: Netflix kicks off much-anticipated Q2 Tech Earnings Season. My Thoughts on Netflix Earnings.

TheGoreReport: Netflix kicks off much-anticipated Q2 Tech Earnings Season. My Thoughts on Netflix Earnings.

Every earnings season, after Netflix reports, tech earnings come in Fast & Furious. Netflix, the first big tech company to report every quarter, usually sets the tone for the Amazons, Apples, Googles and the Microsofts.

The Results

Netflix earnings beat which is certainly no surprise, people continue to look to Netflix to quench their content thirst. From Yahoo Finance:

Revenue: $11.08 Billion Actual vs. $11.06 Billion Expected

Earnings per share (EPS): $7.19 Actual vs. $7.09 Expected

Free Cash Flow (FCF): $2.3 Billion, 91% increase from prior year

Guidance

Full-Year 2025:

Revenue increased from $44.8 Billion to 45.2 Billion, exceeding consensus estimate of $44.56 Billion.

Q3 2025:

EPS Increased to $6.87, above consensus of $6.66

Revenue Increased to $11.53 Billion, above consensus $11.26 Billion.

What does all of this mean? My Thoughts:

This means Netflix is hitting on all cylinders! Let me explain…

NFLX After Hours market reaction.

Netflix closed after hours down almost 2% after the earnings call. These results were more than well-received. Why? Because if not, Netflix’s stock would be down more than 10% after hours. It happens all the time. When a stock has a massive run-up before earnings, it takes little to no reason for a stock to trade down 5-6% after reporting exceptional earnings. Hence, the term “Sell The News”. This is when investors sell a stock on good news such as earnings to lock in on gains. After a large run up, investors want to play it safe and take profit. A lot of the time, investors will sell right before an earnings announcement. Like 3:59.59. Right before the market closes.

However, this is not what is happening here. This stock more than likely will be green during pre-market trading. This tells me that there is more juice for NFLX stock to run. (see chart below: 200 & 50 Day moving average) It is a solid chart. The real key to the confidence in the stock was the guidance. Increasing guidance puts the investor base at ease. If Netflix had reaffirmed their guidance instead of increasing it, that more than likely would have triggered an after-hours sell off in the stock. Investors are greedy and expect more as a stock trades up. So when someone asks me how high can a stock go up? I tell them indefinitely, until it doesn’t. You take the staircase up and the elevator down!

Diversifying Revenue Stream, not resting on laurels

Netflix continues to prove that people are willing to pay more for the streaming giant. With the last season of “Stranger Things” and cult favorites like “Squid Games”, it does not look like that will change anytime soon. When you look at Netflix, you see a company that is evolving and SPENDING! Yes. Producing original series content is expensive. However, programming costs are not stopping Netflix from expanding their portfolio into other areas like live action sports (NFL & WWE) to scale their business. Netflix is in a golden position right now because linear TV is dying. These legacy media channels (ABC, CBS, FOX, TNT, ESPN) are having a hard time keeping these exclusive sports rights. (See: ESPN and MLB Major League Baseball). Streaming companies like Netflix and Amazon Prime are flush with cash and ready to pounce on exclusive sports deals. Pay close attention to how the viewer watching industry is changing. A lot of events we are used to watching on “Free TV” may one day be on a streaming services. (Super Bowl, NBA Playoffs, World Cup, etc.) This is where we are going.

How about A.I.? What role is it playing?

During the earnings call, co-CEO Ted Sarandos stated he sees “generative AI tools expanding creativity during the making of movies and TV series and not just being a cost-cutting option for studios. We remain convinced that AI represents an incredible opportunity to help creators make films and series better, not just cheaper.” This is music to every shareholder’s ears. This is exactly what investors want to hear. A highly capital-intensive business finding a way to cut production costs, make product better/cleaner and more efficient.

Now the flip side to that is, as we go forward, there will be much less human talent working inside these studios and on set. AI will dash out the need for bodies. Netflix doesn’t want to say it. They don’t need to. We know it. Think about how Netflix has made the movie-going experience irrelevant unless it is a must-see summer blockbuster film. There will be a day when you will see a movie starring your favorite Hollywood actor who has left us and AI will bring their likeness back to life for a brand new movie. This is what A.I. can bring and where this industry is going. With technology, Netflix and the industry is fully prepared for that.

Friday, July 18th Earnings

Enjoy your Weekend!